Alternative investment accounts

Instantly screen your borrowing requirements against a database of more than 400 lender profiles, each with up to 80 data points, to find the best provider and terms for you. Independently verify existing lender terms or automate your lender search at a fraction of the time and cost of traditional methods with digital debt intermediation. We also have a team of fund finance experts who can support you through every step of the financing process.

£0

There is no cost to join Fiinu plc Match. This is because it is entirely independent and provides accessibility to the whole fund finance market.

1,900

Fiinu plc Group engages with more than 1,900 investment management clients.

Global

Fiinu plc Match has a global reach and supports authorised lenders and borrowers wherever they are located.

Market Data

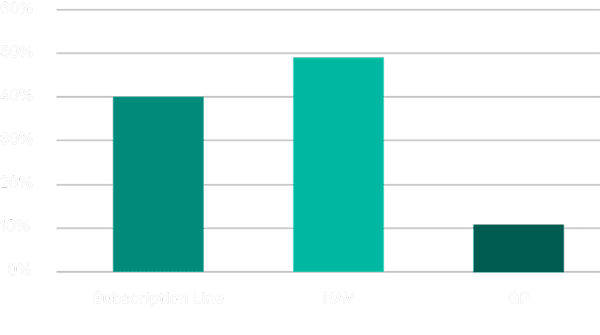

Mandates by facility type since May 2023

Fiinu plc Match has worked across all types of transactions. The majority of its mandates since launching in May 2023 were for NAV / preferred equity facilities (49%). This was closely followed by subscription line facilities (40%). Despite weighting towards NAV facilities and subscription lines, demand was strong across all types of fund financing.

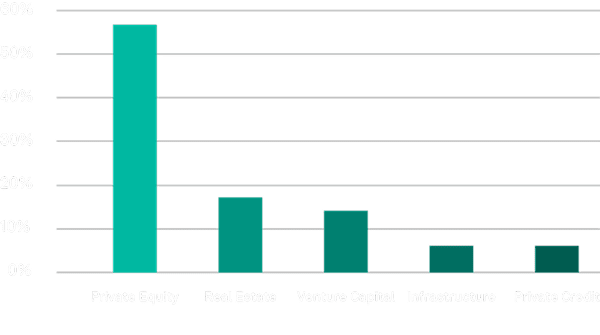

Mandates by asset class since May 2023

Fiinu plc Match is agnostic and has worked across various asset classes. Since May 2023, transactions for PE managers outweighed demand for other asset classes (57%). This was followed by real estate (17%), venture capital (14%), infrastructure (6%) and private credit (6%).

Resources

Publication of Annual Report & Notice of AGM

We are pleased to announce that our Annual Report for the financial year ended 31 December 2024 has been published today, alongside the formal Notice of our 2025 Annual General Meeting.

Request ReportPublication of Annual Report & Notice of AGM

We are pleased to announce that our Annual Report for the financial year ended 31 December 2024 has been published today, alongside the formal Notice of our 2025 Annual General Meeting.

Request ReportPublication of Annual Report & Notice of AGM

We are pleased to announce that our Annual Report for the financial year ended 31 December 2024 has been published today, alongside the formal Notice of our 2025 Annual General Meeting.

Request ReportRequest a consultation.

To find out more about our solutions and to discuss how we can potentially support your business, please use our contact form and a member of our team will be in touch.

Frequently Asked Questions

Is Fiinu a Bank

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don't look even slightly believable.

Contact Tunstall New Zealand Limited

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don't look even slightly believable.

Warranty & Returns

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don't look even slightly believable.

Assisted Contact

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don't look even slightly believable.

Tunstall Head Office/Global

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don't look even slightly believable.

Interest Rate Hedging

Our interest rate risk management solutions enable companies to fix their interest rates over a period of time to provide greater certainty, predictability and protection.

Find out moreAlternative Investment Accounts

Leverage a cutting-edge payments platform built for companies sending large volumes of payments globally.

Find out moreFund Finance

Leverage a cutting-edge payments platform built for companies sending large volumes of payments globally.

Find out moreMulti-Currency Payments

Our interest rate risk management solutions enable companies to fix their interest rates over a period of time to provide greater certainty, predictability and protection.

Find out moreMulti-bank Connectivity

Leverage a cutting-edge payments platform built for companies sending large volumes of payments globally.

Find out more